ITALIAN LUXURY REAL ESTATE WITH HISTORICAL AND ARTISTIC VALUE IS PASSING INTO FOREIGN HANDS

Russian oligarchs, American tycoons, wealthy Chinese, Asian scoundrels, British ready to escape from the Brexit and entrepreneurs from Northern Europe: they are all on the hunt for prestigious properties in Italy, became a tax haven, attracted by favorable taxation.

The tax mechanism is such that foreign buyers are encouraged to buy, intensified the appetites of wealthy foreigners to whom the Italian taxman winks, and for those who have had a foreign residence for many years and move to Italy, they can choose to activate a special “flat-tax”, a fixed tax of 100,000 euros per year.

WHO BENEFITS FROM THE TAX ADVANTAGE

The law is operational with instructions and a special check list developed by the Revenue Agency. The novelty, according to some estimates, could immediately affect a thousand subjects and aims to become a new tax haven and to compete with countries like Spain and Great Britain (now affected by Brexit) which thus attracted Emirs, footballers, singers.

The concession will only apply to those who have resided abroad for at least 9 tax periods in the last 10 years and are easily activated: it therefore aims at foreigners and keeps those who have moved from Italy abroad in recent years.

The convenience, of course, is especially present for those who have large assets and incomes. But even for those with large families with earnings at many zeros, family members will also be able to benefit from the tax-lump sum, paying the taxman 25,000 euros. (see here)

The option, introduced with the 2017 Budget Law, provides for the payment of a flat-rate tax of 100.000 euros for each tax period for which it is exercised.

THE RACE TO THE NEW TAX HAVEN HAS ALREADY STARTED

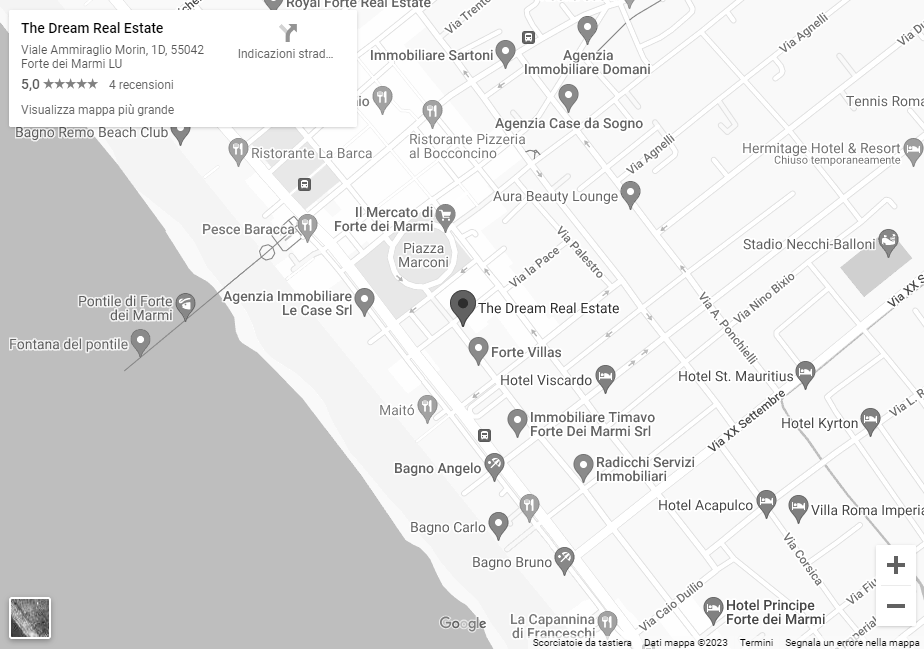

Architect Francesco Mottini, head of the international sector of The Dream Real Estate, which deals with properties worth more than € 2 million, explains that purchases of historic homes and extra-luxury properties in locations unique in the world have accelerated. «We receive many requests and a good percentage for property of important historical and artistic value. While until a few years ago the buyers were mainly Americans, Russians and Arabs, the market has now opened up. Wealthy Australians, Africans and Asians turn to us ».

Sales also run online. About 3 million citizens from across the Alps are looking for luxury properties in the “Bel paese” thanks to the flat-tax, to buy a luxury home.

The Euro has halved assets and young people have inherited assets that they are no longer able to maintain with their current incomes. In addition, taxes have increased. Brexit is pushing numerous wealthy people to leave London. They choose Italy for life style and hystorical heritage.

Browsing among the major websites specializing in luxury real estate sales, dozens and dozens of advertisements appear. Numerous are the ones above one million euros, with peaks reaching 20 million Euro. It is not just private individuals who move. The Italian real estate market is at the center of attention of sovereign wealth funds of the Arab countries, American private equity, French and German insurance companies and Chinese financial companies.

The investments made by these giants are estimated to exceed 25 billion Euros.

The Qatari funds bought the Baglioni hotel and the Excelsior in Rome, the Starwood in Florence, the Gritti in Venice, the American Express’s building in Piazza di Spagna in Rome where they opened the Valentino fashion couture store.